Appliance Insurance Claims: What Coquitlam Homeowners Need to Know About Coverage for Repairs and Replacements

Wondering if your home insurance actually covers that broken dishwasher or flooded basement from your washing machine? Most Coquitlam homeowners are shocked to discover that standard policies offer far less appliance protection than they assumed, leaving them vulnerable to thousands in unexpected repair costs.

When your refrigerator suddenly stops working on a sweltering summer day or your washing machine floods your finished basement, the financial impact can be devastating for homeowners. Understanding appliance insurance claims and what your homeowners policy actually covers is crucial for protecting your investment and avoiding unexpected out-of-pocket expenses. While many homeowners assume their standard policy covers all appliance repairs and replacements, the reality is more complex, involving different types of coverage, specific conditions, and important exclusions that can leave you financially exposed.

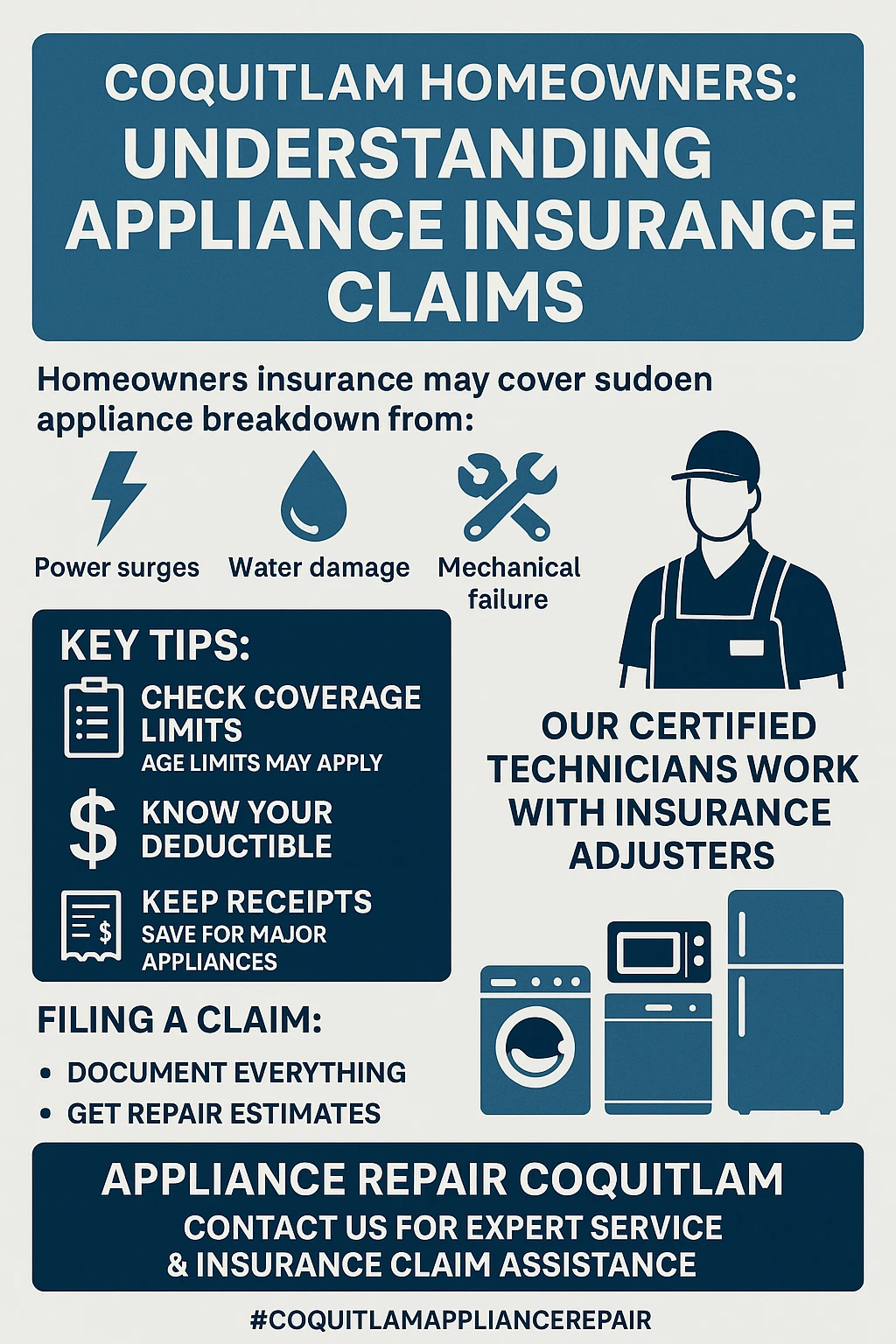

The confusion around appliance coverage stems from the fact that most standard homeowners policies only protect against external perils like fire, theft, or sudden water discharge. Internal mechanical breakdowns, which account for the majority of appliance failures, typically require additional coverage that many homeowners don’t even know exists. For Coquitlam residents dealing with the region’s wet climate and frequent power fluctuations, understanding these coverage gaps becomes even more critical.

Smart homeowners are discovering that equipment breakdown coverage, available for as little as $29 per year, can provide comprehensive protection for all major appliances and systems. This affordable add-on fills the gaps left by standard policies and can save thousands when your HVAC system fails in the middle of winter or your refrigerator breaks down during a family gathering.

Key Outtakes:

- Standard home insurance covers appliances damaged by external perils like fire or theft, but typically excludes mechanical breakdowns and normal wear-and-tear

- Equipment breakdown coverage is an affordable add-on that protects against internal mechanical and electrical failures, costing as little as $29-100 per year

- Age of appliances generally doesn’t disqualify coverage unless specifically excluded, but proper maintenance is required to avoid claim denials

- Water damage caused by appliance failures may be covered for resulting property damage, but the appliance itself often requires separate breakdown coverage

- Proper documentation and prompt reporting are essential for successful appliance insurance claims, with adjusters requiring detailed evidence of damage and cause

Understanding Your Home Insurance Appliance Coverage Options

The foundation of appliance protection starts with understanding what your current homeowners policy actually covers versus what you think it covers. Most homeowners operate under the misconception that their standard policy provides comprehensive appliance protection, but this assumption can lead to costly surprises when claims are filed. The reality is that standard homeowners insurance operates on a “named perils” basis for appliances, meaning only specific, clearly defined causes of damage are covered.

Standard homeowners policies typically cover appliances only when they’re damaged by what insurance companies call “covered perils.” These include dramatic events like fires, lightning strikes, theft, vandalism, or sudden water discharge from plumbing systems. Built-in appliances like furnaces, water heaters, and central air conditioning systems fall under your dwelling coverage, while portable appliances such as refrigerators, washers, and dryers are protected under personal property coverage. However, the most common causes of appliance failure – normal wear-and-tear, mechanical breakdowns, and age-related deterioration – are specifically excluded from standard policies.

This is where equipment breakdown coverage becomes invaluable for Coquitlam homeowners. This specialized coverage, available as an endorsement to your homeowners policy, specifically addresses the gaps left by standard coverage. Equipment breakdown coverage protects against sudden mechanical or electrical failures that would otherwise leave you paying thousands out of pocket. The coverage typically includes major appliances, electrical systems, heating and cooling equipment, and even home electronics, providing comprehensive protection for as little as $29 to $100 annually.

The coverage limits for equipment breakdown protection vary significantly by insurer and policy level. Basic coverage might start at $50,000 total per policy period, while comprehensive plans can provide coverage exceeding $1,000,000. Most policies also include additional benefits like business interruption coverage if you run a home-based business, spoilage coverage for food lost due to refrigerator or freezer failures, and even coverage for the increased cost of temporary repairs during parts shortages.

For Coquitlam residents, smart home device integration has become an increasingly important factor in appliance insurance coverage. Many insurance companies now offer discounts of up to 20% for homes equipped with smart monitoring systems, water leak sensors, and connected appliances. These devices not only help prevent claims by providing early warning of potential problems but also demonstrate to insurers that you’re taking proactive steps to protect your property. Smart thermostats can prevent freezing damage, water sensors can shut off supply lines before minor leaks become major floods, and connected appliances can alert you to maintenance needs before catastrophic failures occur.

What Appliances Are Covered and Common Exclusions

Understanding exactly which appliances qualify for coverage under different policy types is essential for making informed decisions about your insurance needs. The scope of covered equipment extends far beyond basic kitchen and laundry appliances, encompassing sophisticated home systems that modern families rely on daily. However, coverage isn’t universal, and certain exclusions can catch homeowners off guard when they need protection most.

Equipment breakdown coverage typically protects a comprehensive range of household systems and appliances. Major kitchen appliances including refrigerators, ranges, ovens, dishwashers, garbage disposals, and built-in microwaves are standard inclusions. Laundry equipment such as washers, dryers, and utility room systems also receive protection. HVAC systems, including furnaces, air conditioners, heat pumps, and related ductwork, represent some of the most valuable covered items given their high replacement costs. Water heaters, whether tank-style or on-demand systems, are universally covered due to their critical role in daily living.

Home electronics coverage has expanded significantly as households become more connected and technology-dependent. Computers, home security systems, smart home hubs, televisions, and audio systems often qualify for protection. Some policies extend coverage to specialized equipment like swimming pool systems, well pumps, sump pumps, and even garden tractors or riding mowers. The key distinction is that covered equipment must be permanently installed or designed for residential use rather than portable consumer electronics that might be covered under separate personal property provisions.

One of the most common misconceptions among homeowners concerns the age limits for covered appliances. According to major Canadian insurers, age alone typically doesn’t disqualify appliances from coverage. Aviva Canada specifically states that they don’t monitor appliance ages for coverage purposes, and claims cannot be denied based on age unless there’s an explicit policy exclusion. However, this doesn’t mean age is irrelevant to claim outcomes.

The critical factor that can affect coverage isn’t age but maintenance and care. Insurance companies can deny claims if there’s evidence that neglecting obvious maintenance contributed to the failure. This means keeping your appliances clean, following manufacturer maintenance schedules, and addressing minor issues before they become major problems. Documentation of regular maintenance can actually strengthen your position when filing claims, especially for older appliances that might face additional scrutiny.

Coquitlam’s unique climate presents specific challenges that homeowners should consider when evaluating their appliance insurance needs. The region averages over 80mm of annual precipitation with more than 54 significant rainfall days, creating conditions that increase the risk of water-related appliance damage and electrical issues. The combination of moisture and temperature fluctuations can accelerate corrosion in water heaters, cause electrical components to fail prematurely, and create conditions where appliances work harder than in drier climates. Winter temperatures that average -5°C in February create freeze-thaw cycles that can damage water-connected appliances and cause power grid instabilities that lead to voltage surges affecting sensitive electronics.

The Appliance Insurance Claim Process

Successfully navigating an appliance insurance claim requires understanding the process from initial damage discovery through final settlement. The steps you take in the first hours after discovering appliance damage can significantly impact your claim outcome, making it crucial to know what to do before disaster strikes. Insurance companies have specific requirements for claim reporting and documentation, and failing to meet these requirements can result in delayed payments or denied claims.

The moment you discover appliance damage, your first priority should be to take immediate steps to prevent further harm. Shut off the water or power supply to the affected appliance if you can do so safely. Document everything with photos and videos, capturing the appliance’s model and serial number, the damage itself, and any resulting damage to your home. Contact your insurance provider as soon as possible to report the incident and initiate the claim process. They will assign an adjuster who will guide you through the next steps, which typically involve getting a repair estimate from a qualified technician.

Frequently Asked Questions

Does my standard home insurance cover my fridge if it just stops working?

Typically, no. Standard homeowners policies cover damage from external perils like fire or lightning but exclude internal mechanical or electrical breakdowns. For that, you would need an equipment breakdown coverage add-on.

Is equipment breakdown coverage expensive in Coquitlam?

It’s surprisingly affordable. Most homeowners can add this comprehensive coverage to their policy for an annual premium of just $29 to $100, which is a fraction of the cost of replacing a major appliance.

Will my claim be denied if my appliance is old?

Age alone is not usually a reason for denial. However, insurers can deny a claim if the failure was caused by a lack of regular maintenance or pre-existing issues that were neglected. Keeping maintenance records can be beneficial.

What should I do first when my washing machine floods the basement?

First, ensure your safety and shut off the water supply to the machine. Then, document the damage extensively with photos and videos before starting any cleanup. Contact your insurance agent immediately to report the claim and get instructions on how to proceed.

Wrapping Up

For Coquitlam homeowners, being proactive about appliance insurance is not just a matter of convenience—it’s a critical component of financial protection. Standard home insurance policies leave significant gaps that can lead to thousands of dollars in unexpected costs from common mechanical failures. By investing in affordable equipment breakdown coverage, keeping up with maintenance, and understanding the claims process, you can ensure that when an appliance inevitably fails, you’re covered. Don’t wait for a disaster to discover the limits of your policy; review your coverage today and protect your home and your budget from the stress of appliance emergencies.